So You Think You Can Outguess the Market? Think again.

Many investors, seasoned ones included, are tempted to maximise investment profits by timing their entry and exit. The prospects of buying low and selling high is appealing, but can one truly beat the market?

Understanding how market pricing works

The market price is a reflection of its current supply and demand based on all available public information. It shows the price that people are willing to pay for to obtain a good, and the price that they are willing to receive to let go of a good.

A low percentage of US equity mutual funds and fixed income funds have outperformed their benchmarks over the past 19 years.

Essentially, the market is an efficient information-processing machine. At every second of the day, it processes billions of dollars in trades in real-time and across borders. This efficiency in setting prices work against mutual fund managers and individual investors who try to outperform through stock picking or market timing. Only 22% of US equity mutual funds and 10% of fixed income funds have survived and outperformed their benchmarks over almost two decades.

It is hence unsurprising that Peter Lynch thinks "far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves."

Resist chasing past performance

Seng Bingyang, Director of LFA said, “Historical results do not guarantee future performance. The tides of change are the only constant in today’s turbulent investment climate. We’ve had clients tell us that they are waiting to get an opportunity that they’ve missed back in the 2008 financial crisis, or that they are waiting for a mutual fund to reach a 20% drop before grabbing it.”

“However, 2020 presents an entirely new investment arena, and thinking that something similar will happen from over a decade ago may not be wise. Similarly, waiting for a mutual fund’s price to drop to a certain percentage, and believing that it will go up again just because it has historically went back up, may not be accurate.”

“While we cannot completely disregard past performances, it is crucial to look at the product’s current assessment. That said, we believe that performances are only the first part of the equation. The second part requires us to continually evaluate a client’s portfolio to ensure that he is always on track to achieving all that is important to him. This is why, here at LFA, we conduct regular portfolio reviews with our clients every six to twelve months, based on their personal preferences, with a strong focus on their financial goals and dreams.”

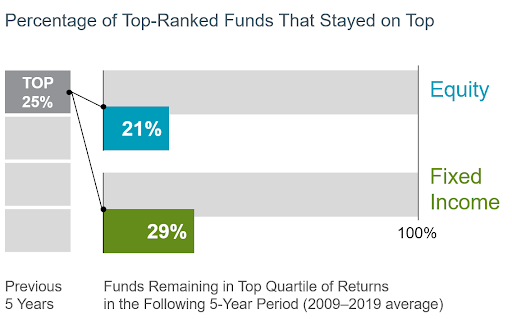

Most funds in the top quartile of the previous three year returns did not maintain their position in the following three years.

Echoing Bingyang’s sentiments, chasing past performances can indeed be risky. Most funds in the top 25% of the previous three year returns did not manage to maintain their position in the following three years.

Even if funds that did well continue to perform, it is unlikely solely due to its past good performance, but rather, current actions and future plans. In this instance, correlation does not imply causation.

Resist reacting to the market

Reacting to the market due to a short-term trend reversal can hurt portfolio performance. In fact, missing just a few days of strong returns can drastically impact overall performance.

Missing a few days of strong returns can hurt portfolio performance.

As evident from the bar chart above, missing just one best day in the S&P 500 Index can cut your annualised compound return by a shocking 4%. Missing five best single days can result in a drop of almost 15%, and missing 25 best single days can almost half the returns that one could have secured by simply staying in the market without reacting.

Warren Buffett aptly captured this notion when he was quoted saying that "we continue to make more money when snoring than when active."

S&P 500 Index

The risk of losing returns when reacting to sudden dips or peaks in the market is aptly captured during the coronavirus period. As evident, the index fell drastically, reaching a low in end March earlier this year. Should investors have reacted to that and sold off their holdings, possibly triggered by fear, they would have realised a drastic loss. In contrast, a calm investor who did not react to the drop, and instead, continued to inject monthly contributions to the index can better ride through the wave.

Let the market work for you

It is not impossible to outwit the market, but it is a very, very difficult endeavour involving a lot of guesswork, particularly for a single investor.

An attempt to beat the market, visualised.

When you try to outguess the market, you are competing with all the collective knowledge of every investor out there. Even professional fund managers are having a tough time beating the market. How many independent investors can say that they have consistently and accurately identified the correct market entry and exit timing without fail due to an accurate analysis, as opposed to luck?

That being said, we can aim to let the market work for us by being part of the collective group of investors. By harnessing the market’s power, you put your knowledge to work in your portfolio. Instead of raking your brains “timing” the market, it may be wiser to focus on “time in” the market by following the market and allowing the miracle of compound effect work for you.