It is never too soon to start financial planning, here’s why.

Everybody knows that financial planning is crucial. However, when you have immediate needs to be fulfilled, it is easy to de-prioritise and push back financial planning. Afterall, if you have to save up for a wedding or buy a car by next year, it is easy to forget about retirement plans 20 or 30 years later.

Financial planning can sound daunting, but it need not be so.

A good financial portfolio not only allows us to streamline the process of achieving financial freedom and fulfilling our dreams, it also allows us to capitalise on compounding interest to grow our wealth faster and hedge against financial insecurities.

This is why it is vital for us to start financial planning early.

Time and Compound Interest

Time allows compound interest to happen, which enables you to grow your wealth passively. The concept of compound interest can be best explained through the scenario below.

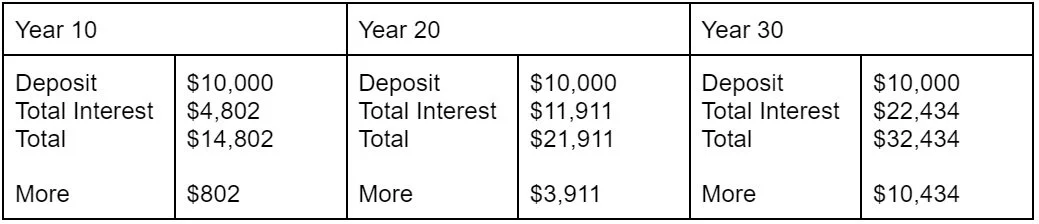

Imagine that you have a $10,000 initial deposit that gives you 4% interest per annum.

After a decade, you will get $14,802, an almost 50% return on investment.

In comparison, if you were to withdraw your $400 returns on interest every year, you will not be able to enjoy the effects of compounding. In this case, you will receive just $14,000 at the end of a decade.

Deposit ($10,000) + Interest ($400 * 10 years) = $14,000

Without compound interest, you lose out on $802.

Now, $802 may sound very little to you. However, take a look at what happens when you stretch it out to 20 and 30 years.

As evident, the loss increases exponentially. While you ‘only’ lose out on $802 after 10 years, you lose out on $3,911 after 20 years, and $10,434 after 30 years.

That’s right, over $10k!

The longer time you have, the more your compounded returns.

Structured Accumulation of Wealth

Another benefit of financial planning is that it allows you to structure wealth accumulation to achieve your financial goals for big ticket items. Examples include:

Retiring Early

Paying for your child’s higher education

Upgrading of home

Purchasing of car

Saving for Retirement

Planning for financial emergencies

Medical Protection

This structuring not only provides you with an outlook and a time frame to achieve your dream goals, it also leverages on compounding interest to help you maximise your returns.

Let us assume that you would like to retire by 55 years old with $500,000. Assuming a constant interest rate of 4% per annum, your yearly deposit required is drastically different if you started at age 25, age 35, or age 45:

As you can see, starting at age 25 gives you a total accumulated interest return of almost $340k, which is almost 2.5x that of your returns should you start at 45. As evident, it is never too soon to start financial planning.

True compounding happens at the end.

If you start your compounding journey too late, you will inevitably need to pay a high price to catch up. This is because you simply do not have enough time for your money to compound.

Starting at a later age not only increases the yearly deposit amount greatly and impacts your cash flow, it also significantly reduces the amount of compounded interest you may leverage to obtain the same amount at maturity. This means that you have to save more aggressively and feel more pressure to hit a certain amount within a reduced time frame.

Additionally, financial commitments also increase with age, such as raising a child, servicing home mortgage loans, and taking care of elderly parents; which can decrease the amount of disposable income you have and make it harder to build up your savings.

The earliest time to start, is now.

Perhaps you were ignorant about compounding, or you were busy focusing on other aspects in life such as your career. You could be too lazy to take any action in the past. Regardless of how long you have delayed your compounding journey, the next best time to start is now.

Financial Planning to hedge against unexpected financial insecurity

If there is one thing that this pandemic has taught us, it is that financial insecurities can come in the blink of an eye unexpectedly. This makes it all the more important to start planning earlier for financial stability to smoothly tide us over periods of difficulty.

Difficulty can come in the form of emergencies (medical, job loss etc), fluctuating markets for investment or protecting your family if you are the sole breadwinner.

The earlier you start, the more security and protection you will have, and the larger the sum of money you can leverage on. Some possibilities include:

Insurance Payouts

Savings Plans

Medical Insurance

If you are unsure of what to do and how to go about planning your financials, speak to us today.